The financial landscape in India is changing with FinTech introducing a technologically supported loan management solution. This technology is the need of the hour where there is a requirement of scalable, flexible, and agile solution in loan management.

India is a country where around 65% of the population falls under the rural economy. For deeper penetration in this market, there is a need for a kind of software that will simplify the process of lending while being cost-effective.

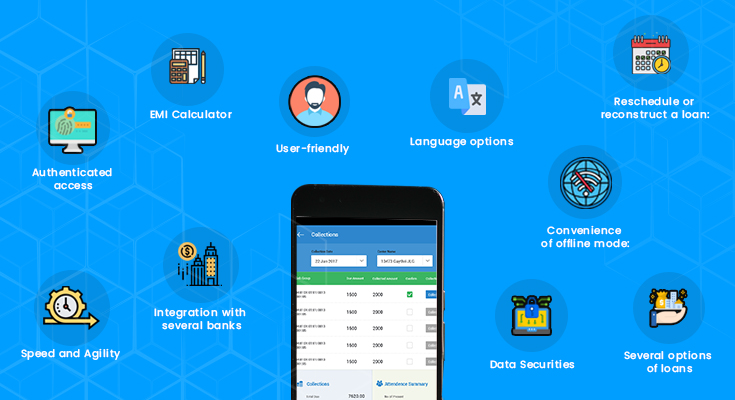

Check out for these 10 characteristics and then choose your loan management system.

1. User-friendly: Loan management is all about simplifying the process of approving a loan. Paperless and hassle-free options make it easier for customers to use the system.

2. Speed and Agility: One of the basic reasons for a consumer approaching an LMS is its quick response to loan approval. So, if the system gives you an option of instant approval, then probably that is the right LMS for you.

3. Language options: To use the system, you need to understand the process flow of the system. When there are options for local language, it becomes easier for any user to get started with the loan procedure easily without anyone’s help.

4. Convenience of offline mode: Though the world is digitized, poor network issues remain a hindrance in many corners of the country. The offline mode of a system will enable using the system even without a stable internet connection.

5. Several options of loans: A person might require loans for anything-from education to business, the requirement of funds might be there anytime. Individual lending, educational loans, micro-housing finance, and micro-enterprise lending options mostly comprise the required types of loans.

6. Authenticated access: Transparency and authentication must be there from both ends. Make sure the platform you are choosing for a loan management solution has options of adding the details to have clarity in the lending procedure.

7. EMI calculator: This will help you calculate the amount you need to pay against your existing loan per month.

8. Reschedule or reconstruct a loan: With this, you can reschedule a loan with a new loan after swapping the outstanding balance from an older loan.

9. Integration with several banks: Needless to say, integration with multiple banks will help the lenders in returning the amount seamlessly through their bank accounts.

10. Data Security: The platform must undertake regular server maintenance that will keep the software updated and avoid data loss.

BizXtend is loan management software which is a product of VolkSoft. The system is designed to ease the process of money lending among the rural as well as the urban population. The multilingual and offline feature of the product makes it accessible by lenders all over the country.