With the ever-growing presence of Artificial Intelligence across industries and borders, changes in the workflows have appeared. Institutions and organizations are working faster, more efficiently, and without error and the Fin-Tech industry is no exception.

The Fin-Tech lending companies, in particular, need to automate a lot of their processes in order to function smoothly and swiftly. Major challenges in the industry, like catering to the unbanked or those without a credit history, has been a constraining point for the lending companies. Machine learning is helping these companies generate credit scores based on alternate data instead of credit history.

That’s just one example of how machine learning is being used by microlending institutions. There are various other facets of a microlending institution that could benefit from machine learning and help them run more efficiently, minimising the effort taken by each process.

So, how does all this help reduce operational costs?

Ayehu reports that intelligent automation, on an average, can cut operational costs by 25-49%. When it comes to IT companies, the numbers are even higher amounting to as much as 55% of cost reductions which is significantly huge.

This is due to the fact that when the right processes are automated, it can take the place of a full-time employee which not only saves the remuneration that the employee was presented with but also the added charges that a micro-lending company, or any company for that matter, have to pay for each employee. This includes health benefits, incentives, allowances, etc.

In addition to this, micro-lending companies need to outsource some of their processes due to lack of technical capabilities. Machine learning will allow microlending companies to eliminate processes like document collection, repayments, and the like.

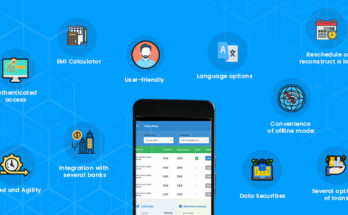

About VolkSoft

VolkSoft is empowering microlending institutions by digitalizing their processes and increasing their penetration in even the remotest areas by providing services like offline mode, mobility, and access in regional languages. For more information on how you can incorporate these at your micro-lending firm, contact us here.