Microfinance has always targeted the rural community of India with an aim to include them in the wave of opportunity afforded by the country’s rapid development. The lack of penetration of banks and lending organizations due to various roadblocks have allowed Micro Finance Institutions organizations proliferate amongst rural communities and maximize adoption of formalized banking services instead of the informal sector.

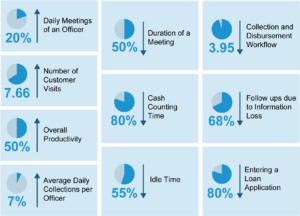

In the Microfinance model, business correspondents are assigned a specific set of villages to conduct business, their responsibilities generally include opening accounts, disbursing loans, collecting repayments and a plethora of other services among others. Traditionally, business correspondents spend a lot of time in never-ending & error-prone paperwork as a part of the job. However, in today’s digital era, these activities can be strategically streamlined by the inclusion of enterprise mobility solutions in their everyday life at work.

With enterprise mobility solutions microfinance will experience a paradigm shift in the way they operate.

Paperless processes:

With the infusion of enterprise mobility solutions in microfinance will eliminate the need for paperwork, reduce logging cash-based payments. With enterprise mobility, microfinance institutions can save hundreds of man-hours every month by eliminating activities involving cumbersome paperwork.

Cashless payment for goods and services:

By enabling mobile banking and fund transfers, microfinance agents in the rural areas can conduct cashless transactions for bill payments, fund transfers, and loan repayment among others.

Efficiency at fingertips:

With enterprise mobility business correspondents, microfinance institutions, banks, and NBFCs agencies can now efficiently transact business, schedule timely electronic payments, manage user portfolios and enable fund transfers at the click of a button. This reduces wasteful manual work and time spent in updating paperwork, manual upload of data, and creates an error-free workflow in the process.

New avenues of expansion:

With the increase in the use of smartphones and features in rural areas, enterprise mobility solutions can now open new avenues in the way commerce is conducted not just in Tier-1 and Tier-2 cities, but also in remote villages. The introduction of seamless mobile internet connectivity has switched the traditional systems of commerce and have enabled a paradigm shift towards a mobile-centric approach.

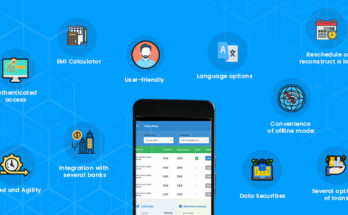

MicroSure is a mobile-based secure, comprehensive loan management software for new age MFIs from the house of Volksoft. To know more, log on to http://volksoft.in/microsure.html