In India, efforts have been made since 2006 to increase adoption of banking in rural areas. However, these areas have proven inordinately expensive for conventional banks to operate in, Hence the reluctance of banks in setting brick and mortar outlets in the 640,867 villages in India.

To minimize cost and maximize efficiency, Microfinance Institutions introduced the Business correspondent model. Theoretically, the Business Correspondent (BC) would be the digitization expert, bank manager, teller, and the cashier of the village they are assigned to. However, the major challenge for Business Correspondents was the lack of resources, real-time technology, data points, and updated ledgers to facilitate smoother operations.

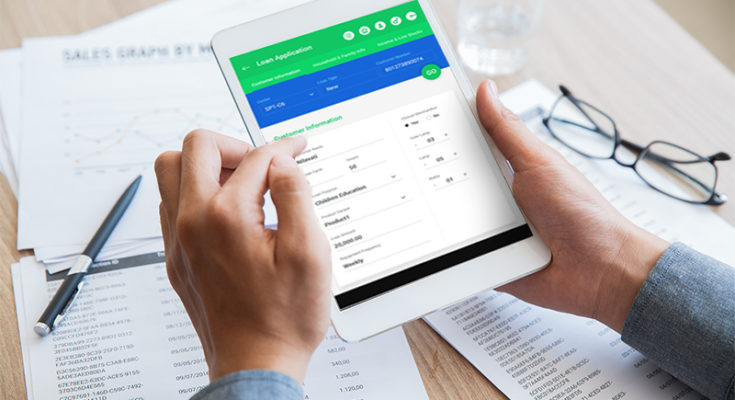

Here’s how Volksoft is empowering business correspondents with their Microlending platform MicroSure:

The key to maximizing operational efficiency in any business is being empowered with the right tools that enable mobility, process efficiency, and ease of access. Technology advancements powered by the Fintech revolution in Microfinance and Microlending is helping equip Business Correspondents with the tools to promote financial inclusion to the last mile at low costs.

Features of the MicroSure platform:

CrediCheck:

Business correspondents in the financial space are always on the move and often travel to remote places in an attempt to realize more business. With CrediCheck, BCs can now have access to information on the move to help them analyze the credit score, applicant history, and nature of repayment of users. With its integrated alerts system, BCs will now be able to efficiently track payment due dates and conduct cashless transactions.

Aadharlink:

In remote India, Aadhar acts as a strong link for MFIs to authenticate and verify their users and also speed up the disbursal process. Before Aadhar was introduced, the agents relied on Voter ID based identification protocols which were both time-consuming and expensive, with Aadharlink, business correspondents now have access to check credit histories of any new applicants, prevent re-disbursal or duplicate payments, and ensure speedy account based loan disbursals instead of cash-based transactions. With easy UPI integration, BCs will now be able to access all the required portfolio of the applicant to conduct the preliminary checks on the spot instead of having to rely on other time-consuming mediums.

e-KYC and Paperless processing:

Enables agents to authenticate using IRIS recognition and biometric scanning. This helps cut down on the time required to validate loan applicants identity through conventional methods such as paper or government identity-based authentication. The integrated tools and on the go access to vital customer information help BCs to conduct paperless transactions by enabling verification through digital signatures and e-receipts.

MicroSure is a mobile-based secure, comprehensive MFI loan management software for new age MFIs. To know more, log on to